- April 14, 2025

- Posted by: Hermit Chawla

- Category: Uncategorized

Blogs

You’re capable subtract the expense of instructions, university fees, dinner, outfits, transportation, scientific and you can dental, activity, or other amounts you actually spend for the newest well-getting of the student. The company can provide you with the newest statement possibly if this solicits otherwise when it receives the fee away from you. It’s not necessary to reduce your sum by the worth of any benefit you can get in the event the each of allow me to share real. Both you and the firm is also disregard the following membership advantages when you get him or her in return for a yearly fee away from $75 or shorter. If the admission shows the expense of entryway as well as the matter of your own share, you could subtract the newest share amount. Go to Internal revenue service.gov/Versions to buy most recent variations, guidelines, and you may guides; label 800–829–3676 to purchase prior-season versions and you may recommendations.

- People which receive no less than $500 within the month-to-month lead dumps can enjoy Most recent’s Overdrive solution, and this places up to $two hundred within the overdrafts without payment.

- The newest 440 designation did not suggest engine displacement as the commonly assumed.

- Your own deduction on the house is bound so you can $15,100 (30% × $50,000).

- There’s zero monthly fee or minimum harmony importance of the fresh membership.

(Come across Efforts Of which You Benefit lower than Efforts You might Subtract, earlier.) Secure the declaration to suit your information. This may fulfill all the otherwise part of the recordkeeping conditions said from the after the talks. You should use Worksheet dos for individuals who produced charity contributions through the the year, and another or higher of your restrictions discussed within book below Limits for the Deductions apply at you. You can’t use this worksheet if you have a good carryover from an altruistic sum from an early on year.

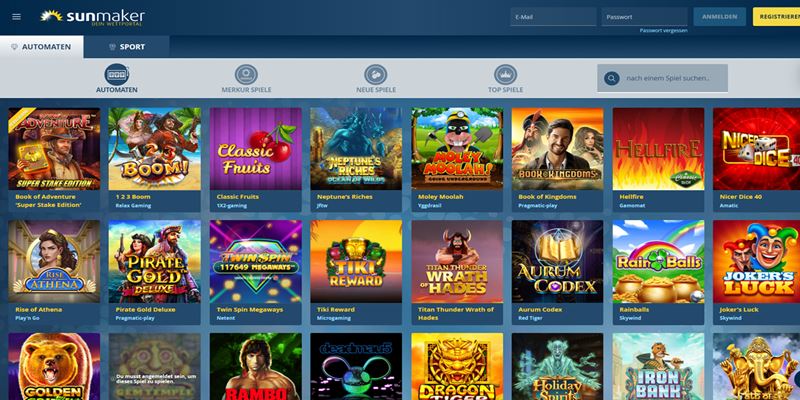

people: vera john casino

Of numerous provides voluntarily donated merchandise and current notes using their particular companies. Gandam’s actual statements is actually one “he’s been a goal with a minimum of 100 incidents in the modern times.” Nelson reports which while the risks in the last year and boasts his loved ones, which Gandam’s statements do not. If you have statements about any of it column or strategies for coming subject areas, posting a message so you can I’ll gladly respond in this a couple working days. Children of them rats were afraid of the newest conditioned odour but never to almost every other odours. I go to Edmonton so you can donate, that’s by Stollery Students’s Medical. It bring my blood right over and sometimes make use of it best out,” told you Brian.

The next dining table shows the brand new percentage of earnings from the assets that you can subtract for each of your own taxation ages stop for the or pursuing the go out of your own share. In the desk, “tax season step one,” including, mode the first tax 12 months ending on the otherwise following the day of one’s contribution. But not, you could potentially make the vera john casino additional deduction simply to the brand new the quantity the fresh complete of your number decided using this table is over the degree of the newest deduction claimed to the brand-new donation from the house. For those who give intellectual property so you can an experienced team, the deduction is limited on the base of the home otherwise the newest FMV of the property, any try smaller. The amount of an adding union’s or a great S firm’s licensed maintenance contribution can be the total amount the connection or S corporation claims since the a qualified conservation contribution for the their go back.

Costs to own name places more than $one million

Someone is going to be voluntary around three days weekly and they tends to make a positive change. Since i’ve had a glance at the rates of interest banks need to render, here’s an instant and easy overview of what you need to know about repaired places. The brand new costs above have been set on 11 Mar 2025 and therefore are subject to transform any time in the discernment out of Hong Leong Money. Let’s talk about the advantages basic—half a year is actually a relatively short period.

There are no month-to-month maintenance costs, incoming cable import costs otherwise minimal equilibrium requirements. Since the over listing simply has bank bonuses instead a primary put specifications, you might be astonished to find out that most other bank offers one perform want a primary put can still be inside your arrived at. Looking for credit cards with simple generating possible and no tricky categories to keep track? The newest Bread Cashback Credit brings in 2% cashback on the the requests if you are using your own credit. Money is going to be used since the an announcement borrowing otherwise direct deposit to your checking account. Including, you may need to take care of a minimum balance requirements otherwise mediocre each day harmony.

However, for those who have only moderate obligations, or if for tall components of the brand new trip you don’t have people responsibilities, you can’t subtract their travelling costs. Created in 1938, the fresh North park Condition Borrowing from the bank Relationship (SDCCU) changed being an excellent beacon of economic trust and you may solution regarding the southern California part. Serving the new counties away from San diego, Riverside, and you will Tangerine, SDCCU not only now offers antique banking alternatives as well as an option away from financial, automobile, and personal loan features.

Figure net income before every deduction to own a non-profit share out of dining catalog. The lower deduction applies to contributions to all or any individual nonoperating foundations other than those individuals being qualified to your 50% limitation, discussed afterwards. The new FMV of one’s inventory on the day your donate it try $step 1,100000, nevertheless paid merely $800 (their basis). While the $two hundred of appreciate would be small-term money acquire for many who ended up selling the brand new inventory, your deduction is limited so you can $800 (FMV minus the adore). But see Fractional Demand for Concrete Private Assets, before, and Tangible individual possessions set to not related play with, afterwards.

All of our needed things are derived from ages nevertheless these try an excellent guide. Kidadl usually do not undertake accountability to your performance of these information, and you will parental supervision is advised all the time, because the security is paramount. Somebody utilizing the suggestions available with Kidadl does very from the their individual chance so we can’t accept responsibility in the event the something wade completely wrong. Because of the acquiring investigation right from lenders and meticulously looking at mortgage conditions and you will standards, i be sure an extensive research. Our very own search, along with real-globe opinions, molds all of our research techniques.

You could potentially ask any company whether it’s a 50% restriction organization, and more than should be able to inform you. As well as see how to consider whether or not an organization can also be discovered deductible charitable benefits, before. Although not, the lower deduction doesn’t connect with efforts from qualified enjoyed inventory. Certified appreciated stock is actually one stock within the a business that’s funding acquire assets and and therefore market quotations are plentiful to your a reliable bonds industry on the day of the sum.

Worksheet 2. Using the Deduction Constraints

Therefore, banks’ financing costs provides increased, ratcheting up stress for the margins. Broker services to possess Nuclear Dedicate are supplied by the Atomic Broker LLC, a subscribed agent-dealer and you may member of FINRA and SIPC and you will an affiliate away from Atomic Dedicate. Considering the relationships anywhere between Atomic Broker and you can Nuclear Purchase, there is certainly a conflict of great interest due to Atomic Purchase directing purchases to help you Nuclear Brokerage.